Is It Easier to Ask for Forgiveness Than Permission? Not for PPP Loans Under $150K

For the last two months, consumers and businesses alike have grappled with the challenging realities of a world operating under the COVID crisis. While Americans have largely been inundated with bad news, one of the few bright spots has been the government’s relatively quick and substantive effort to provide the financial support necessary to keep the economy intact. Legislation to supply small businesses with government loans was swiftly enacted through the Paycheck Protection Program, providing over $500 billion in support to more than 4.3 million businesses. While these efforts have been broadly applauded, the policy prioritized speed to implementation over thoroughness, resulting in gaps that are causing pain for both small business recipients and the bank facilitators of these loans.

One of the primary gaps that has come under scrutiny in recent weeks is the process for businesses to file for PPP loan forgiveness. On May 15th, the SBA published the Paycheck Protection Program Loan Forgiveness Application, an 11-page document required for the process. While this document has served to clarify some outstanding questions surrounding eligibility, it represents a significant burden on businesses seeking forgiveness. Due to both its length and complexity, we anticipate the combined resource requirements of operators’ time and/or third-party expenses to represent an effective cost of $2-4k for each business that applies for forgiveness, requiring 20-100hrs of focused time from key leaders of these businesses. For smaller businesses who function without full-time finance professionals, leaders need to be focused on managing their businesses through these crises - not dealing with paperwork and reading complicated regulations in an attempt to play amateur accountant. With an average loan size of less than $19,000 for the smallest 60% of loans, this estimate would represent 10-20% of the loan amount itself, which is otherwise intended to support payroll, rent, and other obligations necessary to keep businesses alive and ready to restart.

Banks, playing their part in this crisis as the facilitator of these loans, also find themselves in less than desirable circumstances. While origination fees (ranging from 1-5% depending on the size of the loan) compensate for the cost of underwriting loans ($500-$1000 on average), the economics behind the maturation of these loans is less rosy. With servicing costs expected to be relatively flat by loan size (~$150 annually) and a lending margin of a mere 65bps (1% APR less 35bps cost of government funds), banks will run a deficit on that smallest 60% of loans to the tune of about half a billion dollars. These institutions find themselves in the awkward position of having loans they would rather see default immediately (with the SBA providing guarantees) than survive to full maturity. The economics look healthier for larger loans, as many of these costs do not scale while revenue does, but most loans (from a unit basis) sit well below that breakeven threshold.

With meaningful burdens placed on both the smallest of businesses and banks, stakeholders are left scrambling for a solution that relieves both parties. One of the levers that has garnered significant attention is the option to grant auto-forgiveness for some segments of loans. Under the assumption that most applicants will qualify for forgiveness, the ecosystem stands to save significantly by foregoing the cumbersome forgiveness application process and redirecting the otherwise required resources to be deployed against more meaningful challenges.

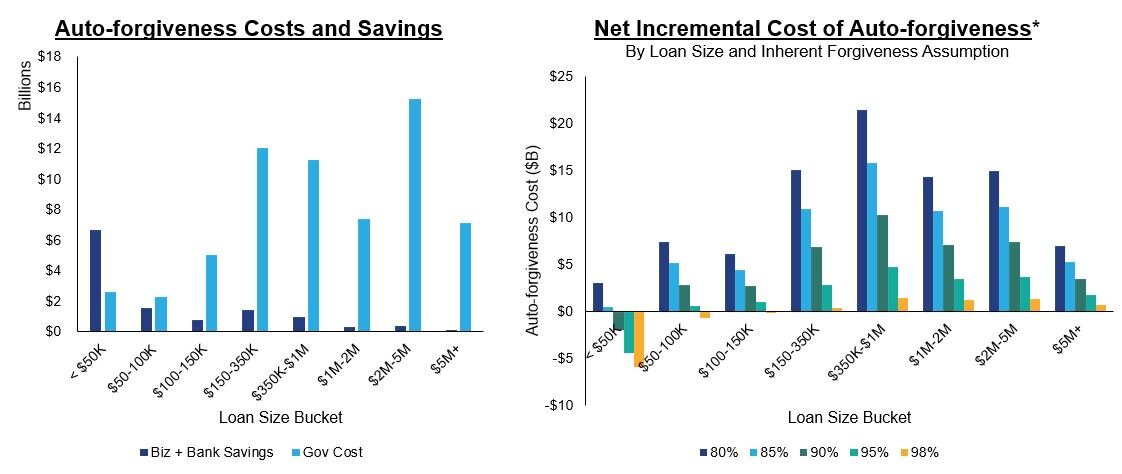

AQN Strategies performed an analysis of the estimated benefit of issuing auto-forgiveness for various loan size thresholds. To inform our sizing of the impact of this decision, key assumptions into costs and revenues for the three parties were generated, utilizing our involvement with participating lenders as a basis.

Business costs were estimated to include interest paid to banks across the life of the loan and the cost of resources needed to apply for the loan and forgiveness of the loan.

Bank costs include underwriting and processing applications for loans and forgiveness, servicing the loans, and paying the government for the cost of PPPLF funds. Bank revenues include origination fees paid to them by the government and interest collected throughout the life of the loan.

The cost to the government was estimated as the incremental loan balances to be forgiven if auto-forgiveness was in place. We anticipate an inherently high forgiveness rate (90%+) as a baseline and recognize key sensitivities to this assumption.

We acknowledge that these costs will vary heavily by lender, by the final forgiveness policies that are set, etc., but they are reliable enough to generally inform us of the effectiveness of this strategy.

Leveraging these assumptions, we set out to estimate the incremental cost that would stem from auto-forgiveness. For example, if we assume inherent forgiveness rates of 90%, we wanted to understand the difference in cost between the government forgiving the remaining 10% of loans versus the costs to both businesses and banks to apply for all 100% of loans and associated costs for those not forgiven. Our analysis suggests that the cost to society (bank profit + business cost) would be lower than the cost for the government to auto-forgive loans under $100K. If policy loosens in a way that forgiveness is inherently more likely, such as by extending the usage window (as currently proposed), then auto-forgiveness may be palatable for loans up to $150K.

With assumed forgiveness of 85-95% by segment, our baseline scenario suggests that the government would forgo an estimated repayment of $10 billion of earmarked PPP funding due to small business repayment as part of an auto-forgiveness strategy up to $150k. If higher forgiveness rates are assumed, then the cost of forgone repayment drops precipitously. We estimate that an auto-forgiveness strategy up to $150k could save US Small Businesses 70 million hours of owner labor. This is time that we all would rather see focused on helping businesses and our economy navigate these unprecedented circumstances.

There are many additional details that add color to this situation, including the role of deterrence that a forgiveness application process serves and what entities should ultimately bear the brunt of the cost stemming from the COVID crisis. With that said, the government’s action to date suggests an outlook that businesses should be provided with the resources necessary to survive in this environment. Our analysis gives us the belief that auto-forgiveness of some of these loans is a reasonable path to ensuring that those resources are kept in the right hands.

Founded in 2016 by a team of accomplished industry executives, AQN Strategies is a boutique financial services consulting firm specializing in lending, payments and consumer retail banking. Our firm has advised dozens of the world’s leading financial institutions including FinTechs, regional banks and multi-national institutions on leading issues and initiatives including credit risk, alternative data, predictive modeling, payments intelligence and most recently around all issues of forbearance, collections and PPP lending that have been introduced with our latest COVID-19 crisis. Led by Stanford MBA graduate Founder and Managing Partner, Ben Sabloff, AQN Strategies has assembled a team of accomplished industry practitioners with real operational experience at some of the world’s most innovative lending companies.