Banks: Use Fintechs to Bolster Your Balance Sheet

Many clients have recently asked AQN how they can start or grow their consumer lending businesses to deploy low-cost deposits. COVID response and government stimulus led to reduced lending and reduced customer spending, resulting in shrinking loan portfolios and growing deposit bases. More banks and credit unions face a deposit to loans mismatch that leads to net interest margin compression; they are exploring ways to quickly deploy capital into new loans.

It's an exciting issue with many interdependent considerations – something we've helped clients with in the past. Much of the initial work is in establishing the answers to business-model-dependent questions such as: what credit segment(s) will I serve, how will I market the product, what will defaults be, etc., etc. Each of these questions requires testing to answer fully. Tests are expensive. Marketing is expensive. Building tech is expensive. And it's all very time consuming – starting a new, in-house consumer lending business can easily take more than a year to launch and longer to deliver positive returns. And once you start, you can't stop without wasting the upfront cost.

There is a better way. Fintech partnerships may be the answer lenders are looking for. Fintechs are often better at sourcing customers than traditional financial institutions. They have slick tech, compelling, targeted products, and national reach. For many banks, it's too late to compete head-on without unrealistic investment. However, banks have a leg up on the cost of funding as demand deposits are still the king of funding costs. The natural conclusion is that banks should partner with Fintechs rather than compete with them.

This idea isn't new. It's just more feasible than ever.

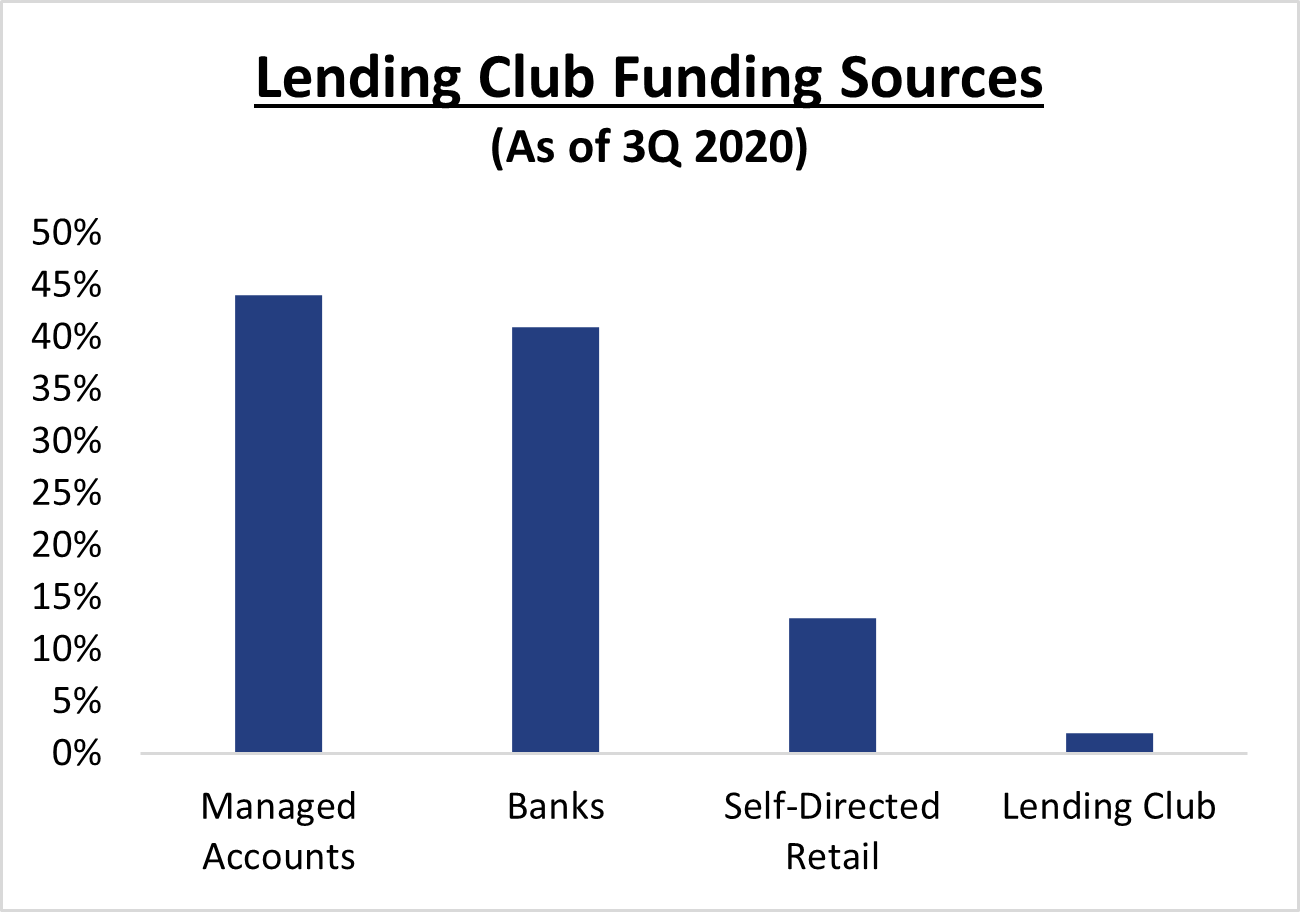

Marketplace Lenders (MPL's) like Lending Club and Prosper pioneered this space. The truth is that peer-to-peer lending never took off and these loans are overwhelmingly institutionally funded. For example, as of 3Q 2020, 41% of Lending Club's loans are funded by banks. Fintechs offer good returns, convenient investment processes, rich loan-level data, and the ability to specify your risk/return profile. If I were running a bank, I'd be more attracted to buying loans on an existing MPL platform than attempting to build my own in-house product. Rather than start a new going concern amid a pandemic, establishing relationships with one or more MPL's offers a low-cost and flexible path to sizeable returns in the unsecured consumer lending space that you can turn off, scale down, or reposition with ease.

MPL's are hardly the only place within the Fintech space for banks to participate. For every snazzy, 5-click loan application, there is an institutional investor somewhere in the background participating in the underlying loans' economics. Affirm, Greensky, Upstart, and other non-MPL originators need institutional money too.

Partnering with a Fintech: A Mid-Sized Banks' Guide

When considering whether to work with a Fintech partner, institutional investors should consider the loans' appropriateness, the deal's suitability, and the relevant risks.

Loan Characteristics

There are many people out there marketing many different loan types: personal, auto, auto refi, point of sale, student, student refi, and many more. All of these differentiate by risk and yield. There is an excellent opportunity to pick the right loans for your balance sheet and risk appetite. Do you want long term, low-risk assets? Med School refis might be great, but don't expect a considerable yield. Are you looking for short-term, high return assets and can accept some risk? Near-term personal loans might be right for you.

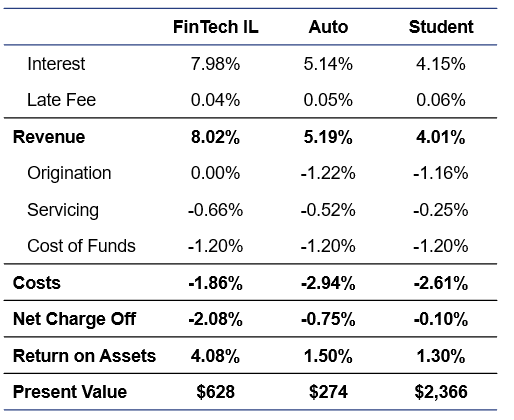

Return Comparison of Same FICO Band by Loan Source

Example, obfuscated returns comparison of multiple Fintech partnerships for a specific client’s buy box.

Beyond loan product, investors can be picky about credit characteristics with FICO or risk-grade floors and weighted average FICO stipulations. The best Fintechs can provide historic, loan-level performance so that you can tailor your strategy on their platform. They can often accommodate other requirements such as APR caps or geographic limitations as well.

Deal Structure

The deal determines how value is shared between the loan originator and the loan buyer, and there are many options. Often there are upfront costs, although sometimes origination fees are pushed to the consumer. Servicing can be retained by the originator or released to the buyer. Either way, there are servicing costs that someone must pay. Credit criteria and distributions are often written into the deal.

Deals in the Fintech & Banking space are varied, and there is some room to negotiate for custom deal terms depending on the relative scale of your investment objectives. Buyers will often get more leverage and better pricing if they commit to buying more for longer. Buying in bulk almost always saves money. And there are ways to get a leg up even if you don't command large purchasing power - targeting loans less desirable to other buyers can result in some of the best deals terms and returns, as opposed to being a price taker with more mature originators.

Program Diligence

Lending is an inherently risky activity, and granting control over essential lending functions to a partner increases that risk. Buyers must be duly diligent about what they're buying. Most sellers use internal risk scores to grade loans, and buyers can choose the credit grades or FICO bands they purchase. But we always recommend independent analysis of loss rates, sensitivities, prepayment rates, and ultimately profitability. Never rely solely on the sellers' representations. Assess the management team and the originator's capabilities to be sure they are aligned with the bank. Diligence doesn't stop when the program starts.

Close ongoing monitoring of the characteristics of new loans and older loans' monthly performance is a requirement. Beyond loan performance, look for changes in credit policy, marketing, or operations. Any shift in underwriting behavior can lead to changes in loan performance.

Even outside of credit risk, lenders want to ensure that they are safe from other risk areas. Compliance, business continuity, legal, reputation… Get comfortable with all the risk categories before you launch a program. Don't wait for issues to arise later.

Be Big, Become Disrupted, or Join In

Banks don't need to compete with Fintechs head-on – especially when they don't already have sophisticated consumer lending capabilities. If you want the attractive returns of consumer lending, you may be able to avoid the upfront costs and learning pains by purchasing loans from an existing Fintech instead.

The specifics in Fintech partnership are very tunable, especially if you have a base of good relationships with multiple non-financial institution underwriters. Depending on what you're looking for, you can buy:

12-month personal installment loans

180-month student refinance assets

Auto or other secured loans

Higher-rate unsecured loans

Whichever credit grade mix suits your appetite

You don't need to make the same level of commitment as you would if you build a new lending program in-house. You can decide early on that you want out, and you wouldn't have enormous sunk costs in marketing and operations holding you back.

When it comes to partnering with Fintechs, the question isn't whether your non-bank competitors originate loans that you want on your balance sheet. The problem is what you want your balance sheet to do and which Fintechs to call first to buy that performance.

Are you interested in learning more? Send an email to Colin Nance, a Partner at AQN, using the form below.