Alternative Data Source Assessment for Point of Sale Lender

Background: A point of sale finance company engaged AQN to advise them on the incorporation of alternative data sources into credit policy

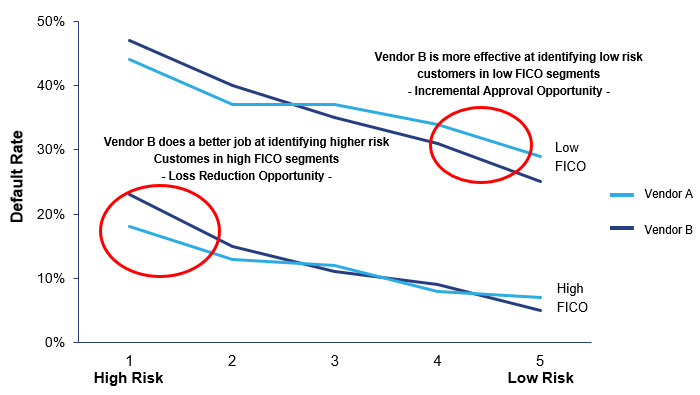

Outcome: AQN Identified that Vendor B allows an 11% reduction in losses versus Vendor A and an 27% reduction versus just FICO at the same approval rate

AQN’s Approach:

Identified the need for using alternative data in underwriting specific market segments

Engaged in talks with 8 different alternative data providers, evaluating product offerings for fit based on portfolio makeup

Scoped out contract details and acquired retro scored datasets from three vendors, appended with portfolio performance data

Leveraged machine learning techniques to identify key data elements, and assess their value for credit policy segmentation

Provided strategic recommendations based on the relative effectiveness and cost of the two vendors

Key Results:

Both data sources slope FICO, but one is much more powerful than the other