Alternative data retroscore, analysis, and implementation for a subprime personal lender

Background: AQN was hired to assess the line management strategy and recognized an opportunity to improve the data used in decisioning, bringing in a new data source to be used in credit policy

Outcome: AQN utilized the improved risk score to design new approve decline and line assignment policies expected to generate over $20MM in annual NPV

AQN’s Approach:

AQN contacted data vendors to discuss data sources and opportunities

AQN created a dataset of the client’s internal application stage data and performance data (where applicable) to maximize the value of the retroscore and the different types of analyses that could be performed

After validating the retroscore, AQN utilized machine learning techniques to identify the variables that best predicted risk and profitability

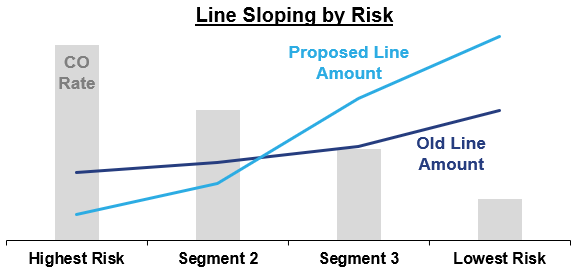

AQN leveraged findings from the analysis to design a new credit policy that better slopes risk/returns

Key Results:

AQN identified several variables that split risk incrementally to the existing credit policy, including a new risk score with significant sloping power