Bank branches keep closing. Maybe they shouldn’t.

Bank branch closing seems inevitable. But is it? From cost to community, Angie Tuglus and Thomas King discuss why this happens, the unintended consequences, and if there is a better way forward.

The building located at 8518 Cople Highway Hague, VA 22469 Photo from: https://www.johndixon.com/auctions/180531/180531_1112.jpg

Thomas: I never thought I would see the day… For every year since 2011, I have driven the nearly 18-mile stretch of Cople Highway, Virginia State Route 202 – a scenic byway that winds through the numerous corn, wheat, and soybean fields that flow upon the coastal flatland of the Northern Neck of the Old Dominion. Coming from the West, after about eight miles, you will come upon a rather standard looking, two-story brick building. For many of my trips, that brick building housed a BB&T branch. I often thought, upon passing that branch, that it would never close. A branch in a rural area – one of only two BB&T branches in the county –would surely be politically difficult and economically damaging for locals if it were to close. Much to my surprise, when driving past in the Spring of 2018, the BB&T sign was gone and the parking lot was empty; the only sign of life being some ivy ascending along the side of the brick.

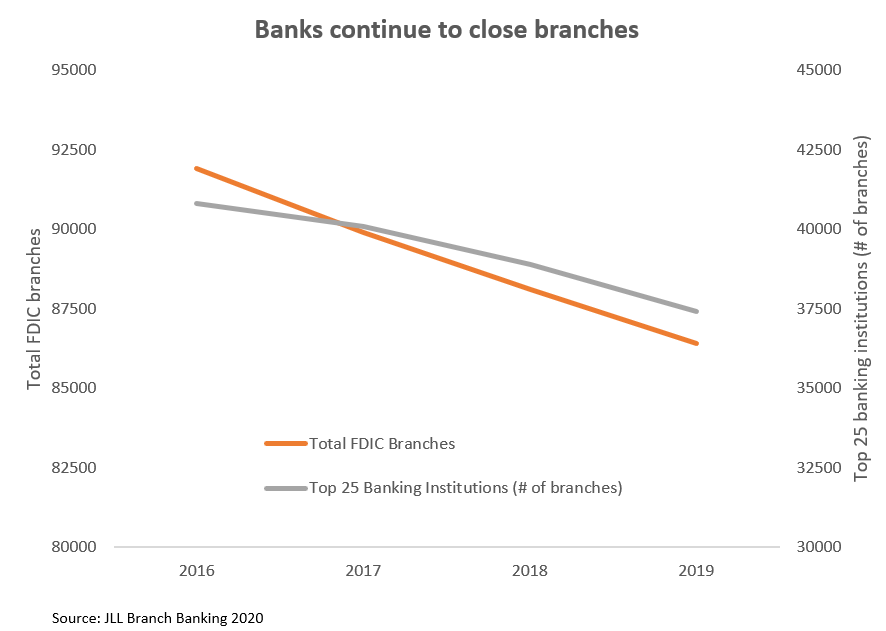

Angie: This is a familiar story. Over the past decade, nearly 12,000 full-service FDIC bank branches have closed across our country[i]. Banks have financial rationales for doing so, but there are many negative implications for communities. It impacts both urban and rural areas, but is especially obvious in communities like the one you described. 20% of branch closures have occurred in rural areas. This has a profoundly negative impact on access to financial services creating “banking deserts.”[ii] Let’s talk about why this happens, the unintended consequences, and if there is a better way forward.

Thomas: Well, what type of branches are the least profitable? Rural, like the BB&T branch, and low income urban. What type of branches would be profitable and thus less attractive to close? Upscale urban.

Angie: Right. They have large deposit bases per branch and an affluent customer base. Jamie Dimon has mentioned in the past that he sees JP Morgan’s biggest opportunity as its wealth customers. JP Morgan Chase had just one private client branch inside a Chase storefront in 2008, and now they have about 3,000[i], demonstrating their investment in those customers. Banks are investing in those branches while closing others.

Thomas: This creates a socioeconomic division. The implications range from limitations on economic mobility and access to financial services, to impacting local small businesses and reducing regional commerce activity. Each implication has political ramifications. The unfortunate reality is, when it comes to bank branches, if you are looking to cut costs you go to where the money isn’t – that is, where there are fewer deposits.

Angie: It’s an interesting conundrum. Closing the branches reduces access to those who need it. And it is not as simple as moving everyone online. The reality is that about 25% of Americans do not have broadband internet at home.[ii] The pandemic really brought this to life. Many people rely on places like their local library for internet. A close friend is a librarian, and when her library temporarily closed due to the pandemic, she made sure their wi-fi was directed at full-strength toward the parking lot so people could come there and use it.

Thomas: Yeah. I mean, look, I am from a small town in Appalachia. I completely get it. It’s a sad reality that there are millions of people in our country that don’t have access to the kind of high-speed internet that enables the two of us to have this conversation over video. Or more applicable to our topic at hand, to conduct personal and small-business financial actions over the internet. It is a massive issue.

Angie: It doesn’t help that there has been a concerted effort, by large banks in particular, to heavily reduce their physical footprint. They are instead making investments in their digital capabilities. Running a digital operation is cheaper and easier to scale. Let’s look at one financial product as an example, mortgages. Quicken Loans grew rapidly with a digital and remote platform, and now rivals Wells Fargo’s mortgage market share. This type of proven new competitor has sent a clear message to traditional banks: they too must have strong digital capabilities. And with the added cost of digitization, the most obvious move is to try to reduce the cost of a physical presence.

Thomas: That ties perfectly into my vignette at the beginning of our conversation. Of course, there are laws and regulations – most notably the Community Reinvestment Act – in place to help ensure low-and-moderate income communities have access to financial services. These regulations are well-intended, but the harsh reality is COVID-19 is forcing banks into a corner. Banks will accelerate the closure of branches to save costs, while there is an increasing need within these communities for access to financial services. Therefore, the decisions banks are making about branches have socioeconomic considerations (access to financial services products, ability to improve livelihoods, cost of business/commerce, etc.), profitability and shareholder considerations, and of course political ramifications. The health and economic impacts of the COVID-19 crisis will have a profound impact on these trends.

Angie: Definitely. You know what always strikes me about this situation? It’s the myopic way in which it is framed. It is always “have branches or go digital.” That is narrow thinking, for multiple reasons. First, let’s consider the operational “cost-save” argument. Banks have numerous options to transform those branches, both in terms of efficiency and customer experience, before closing. It is rare to see a bank truly innovate and transform branches to try different models. Banks must go beyond the “way things have always been done”, in order to re-imagine the branch facility itself and expand their vision of its purpose.

For instance, one thing I find interesting is how only branch employees work in branches. With a world of increasingly capable remote working, why do employees need to be heavily concentrated at headquarters? There could be a more distributed model, with back-office employees also working from the branches. Salary costs could be reduced due to differences in cost of living. And it certainly wouldn’t hurt to get some of those employees closer to the customers. Plus, it costs a lot to close a branch, and real estate is plummeting. Why not experiment instead?

Thomas: That’s a great point. That could also bring more jobs to those areas and help the communities.

Angie: Absolutely. Now let’s look at it from another angle. Imagine a utopian technological landscape for a moment. We have solved the internet issue and everyone can – and wants to – bank digitally. Step back and think about market differentiation. When all banking is online, with no local touch points, how different does it really look to a customer?

Thomas: Funny, that makes me think of something a former colleague of mine at QED, Frank Rotman, says with frequency: “would a rational consumer, armed with perfect information, choose your product?” Differentiation is hard in the scenario you just laid out.

Angie: Yes, it is. I believe this continued movement toward full digitization is only accelerating the commoditization of financial services. Every time a bank closes a branch, it is no longer part of the community, and that advances commoditization. With no presence – physical facility or employees – in their community, it becomes easier and easier for consumers to see all banks as the same. Once that happens, a bank’s entire livelihood depends upon marketing and competing to offer the best rates.

Thomas: That sounds like a race to the bottom – and who wants to be there? It reminds me of how I choose a credit card. Best cash back, best rewards value. That’s all that matters.

Angie: Exactly. Take the risk of a race to the bottom, add in the detrimental effect on the community, and it is clear that we need another option for both the banks and communities. A short-term financial view may suggest simply closing branches to save costs, but banks should think a little harder before pulling the plug. Finding a way to continue to have a physical presence and fulfilling the financial needs of a community can be a win-win.

Thomas: So, what is a bank to do? We are in the midst of a unique and devastating health event, that has created an extremely difficult economic situation. Meanwhile, you have this branch network that is critical to the economic health of communities, but is causing (in certain locations) financial harm on your institution and shareholders. You’ve been a financial services executive – what should they do?

Angie: Banks need to step back from short-term profits and take a serious look at their long-term goals. Think about community and commoditization and consider all the possibilities. Don’t view it as a binary decision. Before assuming your only options are to cut or keep, first try to re-imagine your branches.

Thomas: And you’re seeing that a little bit, at least immediately. Branches being used for operational and customer management functions. For example, the Head of Consumer Lending at Bank of America, Dean Athanasia, said that they are doing more outbound calling from branches than they ever have before – the COVID-19 response is allowing Bank of America to “discover a lot of different attributes to the financial centers. We could add to them, enhance them and make them better and make them more efficient.”[iii]

3 Strategic Steps

- Expand the conversation from closing or keeping branches to reimagining the power branches can have

- Take a long term view and think about how branches could mitigate commoditization of your business

- Leverage branches to engage communities and be agents of positive change

Angie: That is definitely a start. I continue to think about the longer term. How are banks going to stay relevant? A race to the bottom for rates in all of their services will not end well. How are banks thinking about what they want their place in communities to be? Not just upscale urban communities, but all communities? Can banks be an agent of change in the fight against racial and socioeconomic inequality? Can branches help in that fight? I think so.

Thomas: It’s a great point. There is certainly a corporate social responsibility piece here as well. Can a branch network serve as a way to form deeper connections, and provide financial support and education, to those communities that have been disproportionately impacted from a socioeconomic perspective? I think they can, but it all starts with reimagining the branch.

Angie: It does. And I don’t think this is something that has to take years of studying and planning to figure out. There are actions banks can take today, to both help their communities and to reduce costs. Pilots and partnerships can be formed quickly.

Thomas: Indeed. The answer for each bank is going to be unique – but discussing and developing a strategy will be critical to avoiding the numerous pitfalls that exist – and ultimately can turn branches from a potential cost burden into agents of positive change for banks, and their communities, alike.

Thomas King is the COO of AQN Strategies (and the President at LF Search, a boutique executive search firm). His lifelong passion is expanding opportunities for others which he does through the formation of deep connections with people; relationships that, together, drive value and create outsized impacts. He can be found at https://www.linkedin.com/in/thomas-king-va/ and tking@aqnstrategies.com

Angie Tuglus is a strategic advisor and former financial services executive. She has deep expertise in business transformation, and a passion for figuring out how to make things possible. She can be found at https://www.linkedin.com/in/angie-tuglus-2809b02/.

Sources:

[i] https://qz.com/1805018/the-probability-your-local-bank-branch-will-be-shut-down/

[ii] https://ncrc.org/wp-content/uploads/2017/05/NCRC_Branch_Deserts_Research_Memo_050517_2.pdf

[iii] https://www.latimes.com/business/la-fi-bank-branches-low-income-20190311-story.html

[iv] https://www.pewresearch.org/internet/fact-sheet/internet-broadband/

Other Sources:

1) “Over the hill” graph: https://www.us.jll.com/en/trends-and-insights/research/branch-banking-2020

2) Branches – by the numbers: https://thefinancialbrand.com/74386/bank-branch-roi-deposits-profitability/